It has been noted that a majority of investors especially first time investors in acquisition of real estate are skeptical. Skepticism, is as such the leading reason why many people do not invest especially in the real estate sector – a sector that has great capacity to change lives!

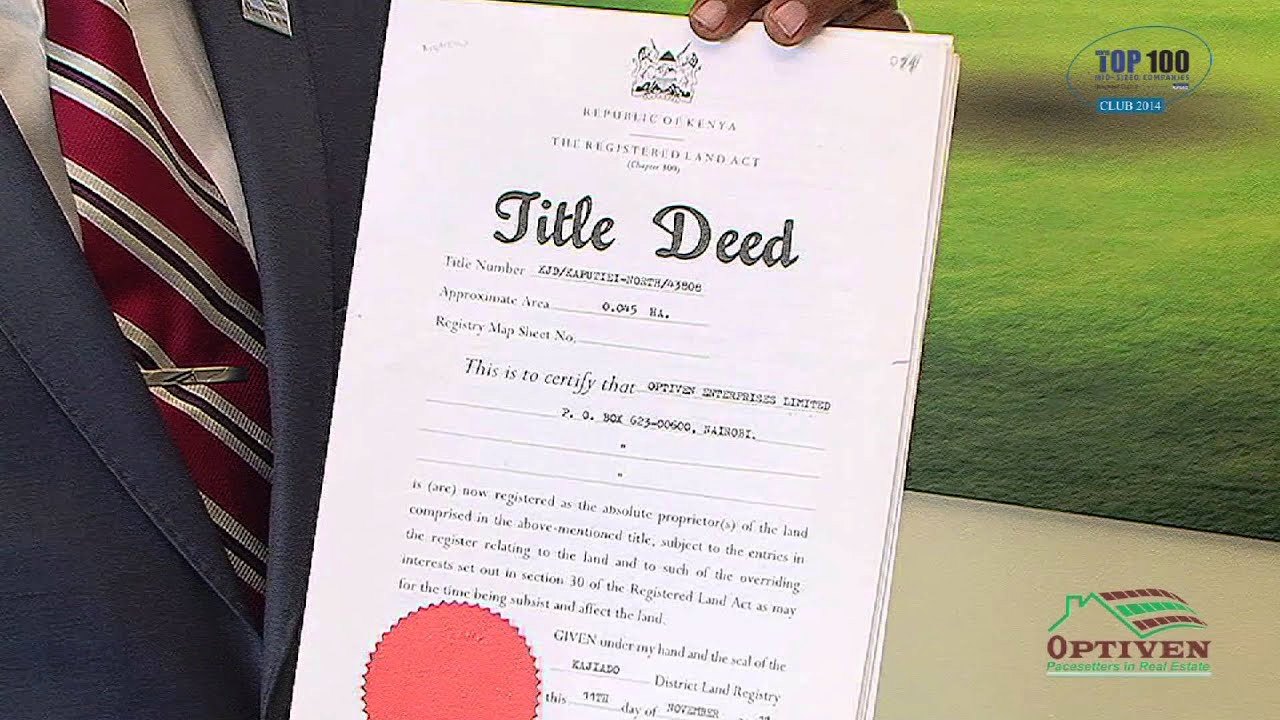

For those who have done it right, they agree that indeed a title deed and a genuine one as such, is life changing! It does not then come as a secret that many are at crossroads as to making that key decision because of the negativity surrounding the real estate sector.

From individual realtors to SACCOs and sadly even church entities have featured in sagas where the public has lost money through dubious real estate dealings. But for first time owners there is a real opportunity that exists to upgrade your investments and lifestyle through real estate.

At Optiven Limited, there are numerous platforms we hold to sensitize the masses about how to spot a dubious deal and of course save your money. In his book, Soaring like an Eagle, founder and CEO at Optiven Group, George Wachiuri shares his own experience of how he lost his all in a rogue land deal. https://www.amazon.com/Soaring-Like-Eagle-George-Wachiuri/dp/9966172181.

For the over 20 years that his company has been in operations, Wachiuri emphasizes, ‘There are no shortcuts when it comes to investing in real estate and at Optiven we insist that three key points must be adhered to”

- One, do your due diligence on the property by searching the title to make sure it is legit.

- Two, real estate is not cheap so for your money, please visit the site and confirm that the land does exist in the first place.

- Three, do a critical background check on the company selling where experience, reviews, testimonies and the professionalism will speak for itself’.

Great advise especially for the skeptical ones and coming from an award winning company that has over 100 projects and some 500 staff operating in three continents, it is a sure bet to invest. For first timers, Wachiuri adds, ‘start small, start smart and start now – with what you have because the dream of owning real estate is possible it is doable.’ https://www.optiven.co.ke/newsblogs/its-all-smiles-for-rafiki-gardens-customers-as-optiven-offers-a-surprise-bonus/

So, we take a moment to digest in-depth analysis of the process towards property ownership

- The property must have a title document. Why? This is important because it will need to be transferred from the company selling the property to you, as the new owner. It is the key that opens the transaction procedures in land ownership.

- Be aware of the land regime. In Kenya, we have leasehold and freehold. Leasehold property is held for a term of 99 to 999 years. Free hold is a term that has absolute ownership by the owner of the property of course upon purchase.

- The initiation of the purchase process begins with an offer letter. This is followed by an agreement for sale signed by the parties involved in the purchase of land. Once a purchaser has fulfilled all the requirements in the agreement with the land selling company, the transfer process then kicks off.

- The transfer process starts with the execution of transfer forms. These require submission of key documents including:

- National identification card

- Kenya Revenue Authority Personal Identification Number

- Passport sized photographs

- Appropriate consents and clearances based on the regime.

- For leasehold, rates clearance certificates will be required after payment of any outstanding rates. There will be need for consent to transfer the property from the Commissioner of Lands

- For Free hold, consent will be required from the Land Control Board as well as rate clearance certificates from some counties.

- Valuation assessment is the next step after the applicable clearance certificates have been obtained. At this point, the documents for the transfer are launched towards payment of stamp duty which is a government requirement.

- Are there any taxes payable? This is a common question once the purchase price of the property has been made. The Capital Gains Tax is often done by the buyer and where it is not applicable, an exemption letter is required. Once this is taken care of, the next step is to apply for Stamp Duty which is payable at 4% for urban areas and 2% for rural areas.

- The final part of the process is the transfer which involves logging of the relevant documents at the Lands Registry.

- The cost applicable at this state include, an advocates fee, stamp duty fee, registration fee and disbursement fee.

- To effect the transfer is a process that takes between four and six weeks but this may be affected by either loss of files at the registry, change of personnel or closure of the registry for purposes of digitization or other factors. https://www.facebook.com/watch/?v=812121409261313

And in understanding this processes, one is now able to enjoy their property and begin the true journey of transforming their lives through property ownership.

By Cathrine Khasoa

Cathrine serves as Lead for Public Relations and Media Liaison at Optiven Limited.

Want to be part of the Optiven Family. Get in touch with Optiven Today

Tel: 0790 300300 / 0723 400500

Email: admin@optiven.co.ke

George Wachiuri Blog: www.georgewachiuri.com

YouTube: https://bit.ly/2VdSuFJ